1-450 Transactions

Real estate transactions will report a wire fraud loss. If we can't keep our clients sagfe, who will?

PCT Safewire exists to ensure every real estate transaction

is free from wire fraud.

According to the FBI, approximately 1 in every 450 real estate transactions has associated fraud reported. It cost consumers and businesses over $221 million in 2019. What if it happened to you?

What would happen to your family if you lost your life savings during the largest financial transaction of your life? What if it happened to your client, your friend, your neighbor, or your parent? Using SafeWire creates peace of mind that you, your clients and your family can close safely, free from wire fraud.

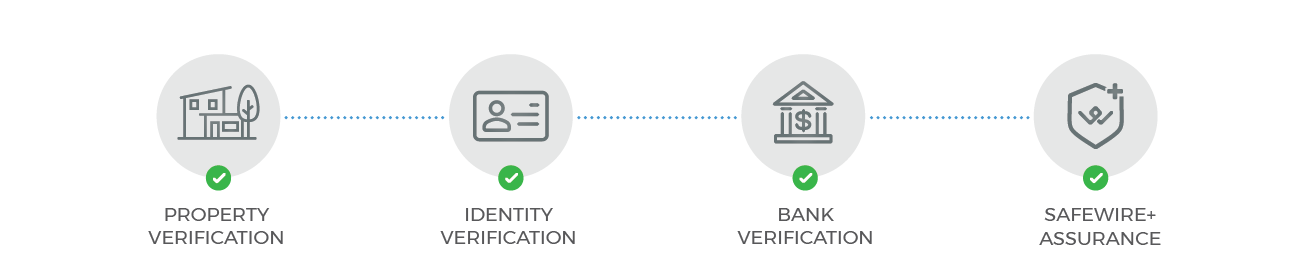

SafeWire is a software, free to real estate brokers and agents, that digitally authenticates buyers and sellers in real estate transactions. SafeWire uses sophisticated multi authentication technology to eliminate unsecured emails within transactions and deliver financial information safely, timely and efficiently. Since 2018, SafeWire has successfully authenticated over 50,000 transactions.

Unsafe Transactions

Courts have found real estate agents up to 85% personally liable if and when wire fraud happens.